Leeds Investment Case

Demand for buy-to-let has had a roller coaster year with multiple rule changes causing artificial peaks and troughs in activity. London rents have calmed down as buyers looked to get in before a 3 per cent surcharge was levied on all buy-to-let purchases in April 2016, whilst Leeds is still experiencing strong growth.

By Sam Davies6/12/20

Leeds Investment Case

Demand for buy-to-let has had a roller coaster year with multiple rule changes causing artificial peaks and troughs in activity. London rents have calmed down as buyers looked to get in before a 3 per cent surcharge was levied on all buy-to-let purchases in April 2016, whilst Leeds is still experiencing strong growth.

Investors, in particular, are becoming increasingly keen on Leeds as a place to invest their cash, with strong demand for student accommodation, a weak pound and the increasingly high cost of real estate in London driving the trend. Recent retail developments, like the award-winning Victoria Gate shopping centre and office development and longer term developments like HS2, are also driving a spike in interest from investors, making Leeds one of the best places to buy property in the UK.

Victoria Gate Shopping Centre: https://www.drapersonline.com/retail/victoria-gate-the-latest-chapter-in-the-retail-renaissance-of-leeds/7013096.article

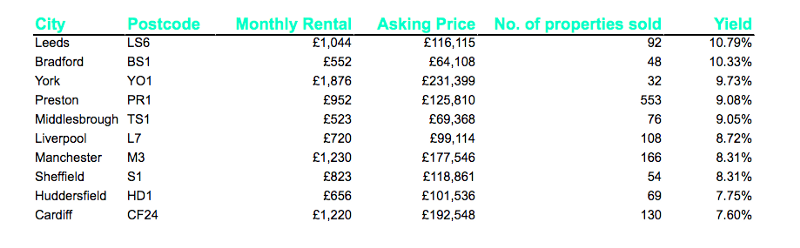

Anyone looking to invest in London’s buy-to-let market today can expect an average gross return of 3.5% whilst those investing in Leeds can expect an average of 8.5%. With UOWN you can see that gross yield at 10.8% which is possible due to our close partnership with The Parklane Group who have great exposure and experience in the student rental market.

In a recent study comparing average house prices vs. average rents across the UK found that the LS6 postcode in Leeds was the highest yielding postcode in the country with an average yield of 10.78%

Source: http://www.totallymoney.com/press-centre/media-release-uks-top-10-high-yield-buy-let-hotspots-revealed/

Late last year Savills residential forecast, seen as one of the most reliable, in the industry says that average UK house prices will remain static this year. In 2018, Yorkshire values are expected to increase by 1.5

This growth in Yorkshire looks set to be fuelled by the shortage of housing and a growing population created by strong economic growth in what Savills refers to as the “Leeds region”. The firm classes this as Leeds, Barnsley, Bradford, Calderdale, Craven, Harrogate, Kirklees, Selby, Wakefield and York.

Take a look at our other articles